The market had a clear narrative for October. Bitcoin, having just crested a new all-time high above $126,000, was coasting on the tailwinds of sustained ETF inflows and the widespread belief that we had entered the "euphoria phase" of the bull cycle. The data models, humming away in the background, were painting a clear picture: a continued ascent, with some analysts confidently projecting a run at $140,000 before the month was out. It was a clean, orderly, data-driven thesis.

Then, a single post on Truth Social threw a wrench in the gears.

President Trump’s sudden threat of a “massive” increase in tariffs on Chinese goods sent a shockwave through all markets, and Bitcoin was no exception. As headlines announced the Bitcoin Price Sinks To $118,000 Amid New Trade Tensions, the market reacted with a drop of roughly 2.3% in 24 hours and a more significant 6% from its peak just four days prior. The move wasn't a mystery; it was a direct reaction to an escalation in the U.S.-China trade war, a messy geopolitical spat that algorithms don't price in well. This single event forces a critical question: What happens when a statistically elegant forecast collides with the brute, unpredictable force of global politics?

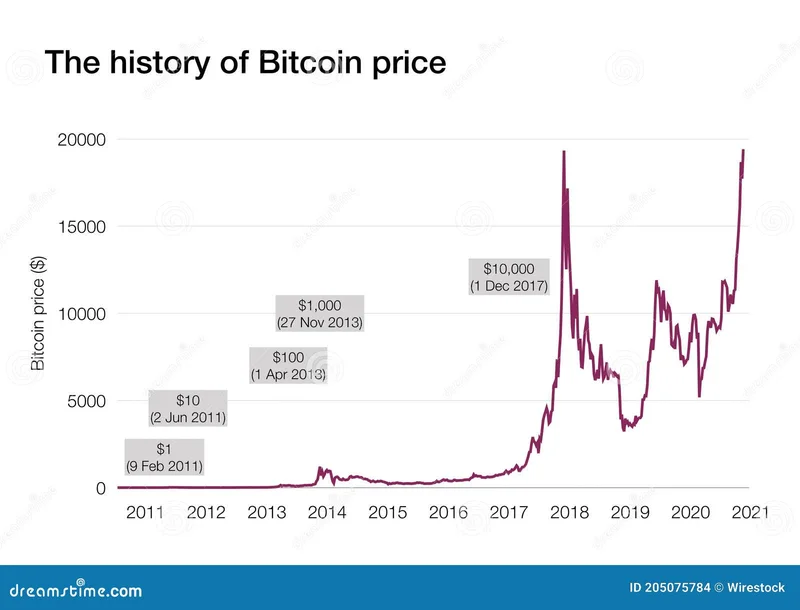

Let’s first examine the case for a runaway bull market, because on paper, it’s compelling. Analyst Timothy Peterson, using an AI-based empirical model, recently projected a 50% probability that Bitcoin would close out October above $140,000, a forecast detailed in reports like Bitcoin Short-Term Prediction: Why The Price Will Cross $140,000 By The End Of October. His bootstrapped simulation, which draws on a decade of data (from October 2015 to 2024), suggests a steady climb, with historical patterns providing a powerful tailwind.

The model's logic is sound, if you accept its premises. October has historically been one of Bitcoin’s strongest months. Certain days—the 9th, 20th, and 28th, for instance—have been bullish over 71% of the time. Bitcoin has already surged more than 30% since the start of the year—to be more exact, it’s a bit over that, but the point stands—buoyed by tangible factors like ETF inflows and expectations of Fed rate cuts. Peterson’s longer-term cyclical model even projects a potential rise toward $200,000 within the next 170 days, assigning it a "better than 50/50 chance."

This is the clean world of data. It’s a world of probabilities, confidence intervals, and trend lines drawn between past events. It’s seductive because it offers a sense of order in a notoriously chaotic market. The model is like a detailed nautical chart, showing the prevailing currents and seasonal winds based on a hundred prior voyages. The problem, of course, is that no chart can predict a rogue wave. And this is the part of the analysis that I find consistently underestimated. How can a model, built on the cyclical behavior of a financial asset, truly account for the non-cyclical, often irrational, behavior of political actors?

The tariff announcement wasn't just market noise. It was a direct consequence of China restricting exports of rare earth metals, critical components for everything from iPhones to F-35 fighter jets. Trump’s response—canceling a planned meeting with President Xi and threatening sweeping import duties—signals a material deterioration in relations between the world’s two largest economies. We saw a similar reaction in April with the ‘Liberation Day’ tariffs (under Executive Order 14257), which rattled global supply chains. This isn't a Bitcoin story; it's a global risk story, and Bitcoin is now, for better or worse, part of that ecosystem.

The immediate fallout was predictable. Crypto-related equities like Coinbase (COIN), MicroStrategy (MSTR), and Robinhood (HOOD) all saw declines between 3% and 6%. This indicates that the market isn't treating this as an isolated dip for Bitcoin but as a systemic risk-off event for the entire digital asset sector. The correlation is undeniable.

This is where the neatness of the statistical models begins to break down. An algorithm can tell you the probability of a 5% drawdown based on past volatility, but it can't tell you the probability of a president waking up and deciding to upend global trade policy. That "Trump variable" is a ghost in the machine, a factor that defies quantification but carries immense weight. The market is now being pulled in two opposing directions. On one side, you have the powerful on-chain metrics and historical cycle data pointing toward euphoria. On the other, you have a geopolitical anchor dragging on risk assets of all kinds.

So, is the $140,000 target for October now off the table? Not necessarily, but the path has become exponentially more difficult. Before this week, the primary risk was an internal market correction—over-leveraged positions being flushed out. Now, the primary risk is external and entirely unpredictable. Will the trade tensions dissipate as quickly as they appeared? Or is this the first step in a prolonged economic conflict that will suppress investor appetite for risk across the board? The models simply can’t answer that. They weren't built to.

Ultimately, this event serves as a stark reminder of the limitations of purely quantitative analysis in a world driven by human decisions. Models based on historical cycles are incredibly useful for establishing a baseline expectation, but they are inherently fragile. They assume a level of continuity that simply doesn't exist when heads of state are involved. The current price action isn't a failure of Bitcoin; it's a stress test of its maturity as a macro asset. The real question isn't whether Peterson's model is "right" or "wrong," but whether Bitcoin's fundamental value proposition is strong enough to absorb these geopolitical shocks and continue its trajectory. For now, the data points to a pause, as the market waits to see which force is stronger: the mathematical pull of the cycle or the chaotic gravity of human politics.