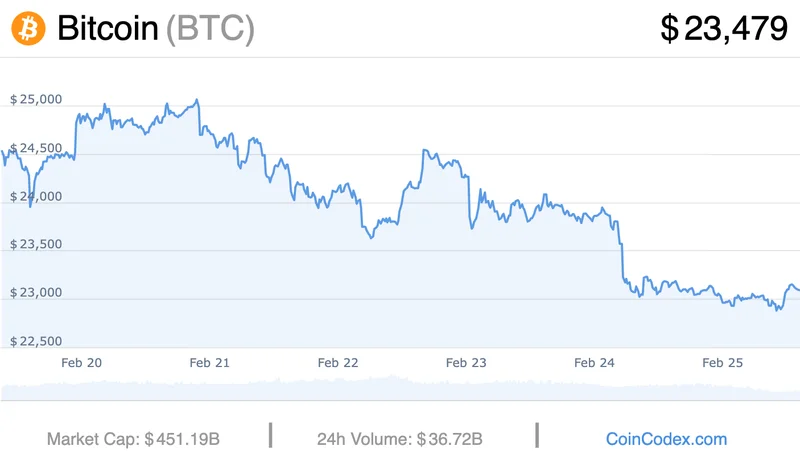

You probably saw the headlines. Maybe your phone buzzed with a notification, the kind that makes your stomach drop for a second. “BITCOIN DUMPS,” screamed the all-caps alerts. The screen bled red, a digital waterfall cascading from $117,000 down past $108,000 in a dizzying blur. The `Dow Jones` was in a nosedive, the Nasdaq wasn’t far behind, and every crypto-related stock from Coinbase to MicroStrategy was caught in the undertow.

The cause? A geopolitical earthquake. President Trump, in a move that sent shockwaves from Washington to Beijing, announced a staggering 100% tariff on Chinese goods, a direct response to China’s own “aggressive” export controls. In an instant, the fragile latticework of global trade buckled. It was a classic, textbook “risk-off” event—in simpler terms, it was a moment where investors everywhere panicked and sprinted for the exits, selling anything that wasn't bolted down. The connection between the geopolitical move and the market reaction was immediate, summed up by headlines like Bitcoin Price Dumps To $108,000, Trump Puts Tariffs On China.

Watching the charts yesterday, I wasn’t scared. I was fascinated. Because what we all witnessed wasn't a failure of a new financial system. It was the violent, shuddering crack of an old one. And in that chaos, we got a crystal-clear glimpse of why Bitcoin was created in the first place.

Let’s be brutally honest about what happened. The fortunes of millions of people, the stability of global markets, and the value of everything from the `price of bitcoin today` to your 401(k) were rocked by a handful of decisions made by a few powerful men. This isn't a critique; it's a statement of fact about the architecture of our legacy financial system. It’s a system of centralized levers and switches, and when someone decides to pull one, the whole machine lurches.

Think of the current global financial order as an old, magnificent, but incredibly rigid iron bridge. For decades, it’s done its job. But now, the political and economic vehicles crossing it are heavier and moving faster than ever before. Yesterday, two of the biggest trucks on the bridge decided to swerve directly into each other. The result was a stress fracture that shook the entire structure. The `S&P 500` fell 2%. The Nasdaq dropped 2.7%. Everything shuddered in unison because everything is connected to the same rigid, centralized beams.

When I first saw the news, I honestly just sat back in my chair, speechless for a moment. Not because of the price drop, but because of the sheer clarity of the moment. We are living through a period of profound instability, where the rules of the game can be rewritten in a single social media post. This reminds me of the 1971 “Nixon Shock,” when the U.S. unilaterally severed the dollar’s link to gold, changing the foundation of global finance overnight. Are we watching the 21st-century version of that? A moment where the trust we place in these centralized systems is being tested in real-time, right before our eyes?

Now, let’s talk about Bitcoin. Yes, the `bitcoin price usd` tumbled. It got swept up in the same wave of fear as every other asset. But here is the critical difference, the “Big Idea” that everyone seems to be missing in the panic. While traders were frantically selling, the Bitcoin network itself didn’t even flinch. It kept processing blocks every 10 minutes, on the dot. It didn’t halt trading. It didn’t need a bailout. It didn’t care about tariffs or presidential decrees.

The Bitcoin network isn't a single, rigid bridge. It's a decentralized, resilient mesh—like a swarm of thousands of smaller, interconnected bridges that can instantly reroute traffic around a problem. One connection gets severed? A thousand others remain. The speed of the market reaction is just staggering—it means the gap between a geopolitical decision and its global financial impact is now measured in seconds, and only a system designed for that kind of instantaneous, chaotic environment can truly survive it.

This is the paradigm shift. While the headlines screamed about the falling `bitcoin price today usd`, the community that understands this technology saw something else entirely. They saw validation. Samson Mow of Jan3 calmly reminded everyone on X, “There are still 21 days left in Uptober,” a nod to October’s historically strong performance for Bitcoin. Analyst Michael van de Poppe went even further, calling this “the bottom of the current cycle.”

These aren’t just hopeful cheers from the sidelines. They represent a fundamental difference in perspective. They see the price volatility not as a weakness, but as an honest, unfiltered reaction to global chaos. In a world of circuit breakers and closed-door meetings, Bitcoin’s transparent price discovery is a radical feature, not a bug. It’s the planet’s most honest barometer of economic anxiety. And if history is any guide, as economist Timothy Peterson pointed out, these sharp October drops are exceedingly rare and have often been followed by powerful rebounds, with past recoveries hitting as high as 21% in a week (Bitcoin slump may rebound up to 21% in 7 days if history repeats: Economist).

The real question we should be asking isn’t, “Why did Bitcoin crash?” It’s, “What does it mean that there’s now an alternative, a non-sovereign financial protocol that can weather these storms outside the control of any single government?”

So, what’s the real story here? Don't get lost in the noise of the daily price chart. The dip to $108,000 wasn't the headline. It was a footnote. The real headline is that the world’s centralized systems are showing their age, and the geopolitical tremors are only getting stronger. Yesterday’s chaos was a fire drill for the future. It was a demonstration of what happens when trust in the old guard erodes. The volatility you saw wasn’t Bitcoin failing. It was the sound of a new system being stress-tested in public, proving its resilience while the old one groaned under the strain. This isn't the end of a cycle. It's the beginning of the great uncoupling.