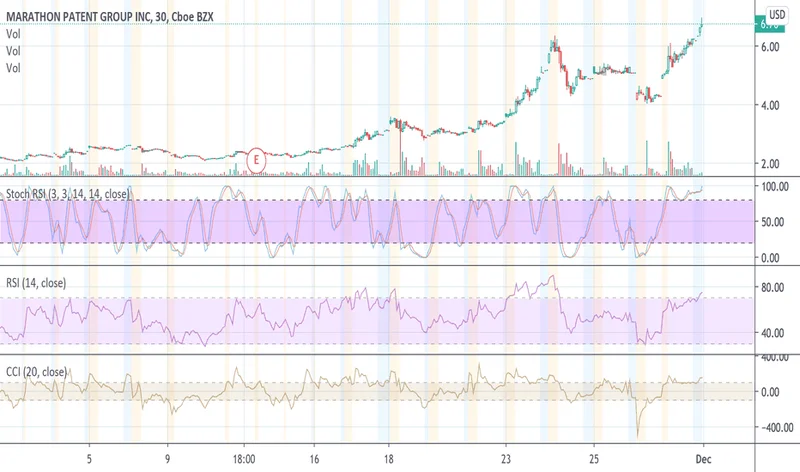

The recent surge in Marathon Digital Holdings (MARA) has captured the market’s attention, with the stock climbing roughly 30%—to be more exact, some reports peg it at 32%—over the last month. On the surface, the narrative is simple: a Bitcoin miner benefiting from a buoyant crypto market. The company’s September production update showed a 4% month-over-month increase, pulling in 736 Bitcoin. The correlation seems direct and uncomplicated. When Bitcoin thrives, so does MARA.

But looking at the valuation tells a different story, one filled with contradictions. MARA trades at an EV/EBITDA multiple of approximately 9x, a significant discount compared to its peers in the mining sector. This isn't the multiple of a high-flying growth stock. It's the multiple of a company the market fundamentally mistrusts. Add to this a reported gross margin of -31.58%, and the picture becomes even more clouded. A positive stock trajectory paired with a negative margin and a compressed valuation is a significant discrepancy.

This is the central puzzle of MARA. The market appears to be pricing it as a pure, high-beta proxy for Bitcoin, subject to the asset's wild volatility and the notoriously thin margins of the mining industry. Yet, the company’s own strategy is rapidly diverging from this simplistic label. The question isn't whether MARA can mine Bitcoin effectively. The real question is whether the market is failing to price in a fundamental transformation happening right under its nose.

Marathon is aggressively repositioning itself. The company is no longer just a Bitcoin miner; it is building an infrastructure play centered on AI data centers and energy generation. The stated goal is to leverage its expertise in large-scale energy procurement and management to serve the voracious compute demands of the artificial intelligence industry. This move aims to unlock new, recurring revenue streams entirely decoupled from the price of Bitcoin.

On paper, it’s a brilliant strategic pivot. The global demand for AI-powering data centers is exploding, and companies that can provide energy-efficient compute at scale are positioned for immense growth. This narrative has driven a consensus fair value target of around $23.32, suggesting the stock is undervalued from its current trading range (which has fluctuated between $18 and $21). The bull case is that MARA is transforming from a volatile digital commodity producer into a stable infrastructure provider.

I've looked at hundreds of these kinds of strategic announcements, and this is where my skepticism kicks in. The pivot is elegant in theory but fraught with execution risk. Building and operating high-performance AI data centers is a fundamentally different business than Bitcoin mining. It requires different technical expertise, different supply chains, and different customer relationships. It’s like a massive, capital-intensive shipping fleet announcing it will now start building and operating a commercial airline. Both involve moving things and complex logistics, but the operational DNA is entirely distinct. Is this a genuine, synergistic expansion, or is it a desperate attempt at "AI-washing" a difficult business model to attract a different class of investor?

The data we have so far is insufficient to answer that. We don't have a clear breakdown of projected revenues from the AI segment, nor do we know the expected margins (a crucial detail given the current negative gross margin). The company is making moves—partnerships with AI and grid management firms are cited—but the financial impact remains speculative. Until those numbers materialize, the market seems content to treat the AI initiative as a high-risk, low-probability call option rather than a core part of the valuation. What percentage of future capital expenditure will be diverted to this new venture, and what will be the return on that invested capital?

The current market behavior suggests investors are struggling to model a company with two starkly different identities. How do you assign a multiple to a business that is part highly volatile crypto miner and part speculative AI infrastructure play? The low EV/EBITDA multiple reflects the risk profile of the former, while the recent stock appreciation hints at a flicker of optimism for the latter.

Imagine the low hum of thousands of servers in a vast, climate-controlled warehouse. For years, that sound was the sound of Bitcoin being created—a digital forge hammering out new coins. Now, the company wants us to believe that same infrastructure, or a version of it, will soon be processing large language models and powering enterprise AI. It’s a compelling vision, but it requires a leap of faith. The market, for now, is refusing to jump.

The reliance on Bitcoin mining remains the company’s operational core and its primary vulnerability. Any significant, prolonged downturn in crypto prices or a new wave of stringent regulations could severely impair its ability to fund the very AI expansion it needs to diversify away from that risk. This creates a reflexive loop: the company needs the Bitcoin business to be profitable to escape its dependency on the Bitcoin business. It’s a precarious balancing act.

The narrative consensus that MARA is 20% undervalued hinges almost entirely on the successful execution of this AI strategy. It assumes the company can seamlessly enter a new, highly competitive market and generate sustainable, high-margin revenue. Is that a reasonable assumption or a speculative hope? Without a clearer financial roadmap for the data center business, valuing MARA today is less about financial analysis and more about assigning odds to a corporate reinvention.

Ultimately, Marathon Digital isn't just a Bitcoin miner anymore, but the market hasn't decided what it is instead. The current valuation is a messy compromise—a blend of crypto-cyclical risk and a sliver of AI-driven hope. The stock is being priced as a high-risk commodity producer with a lottery ticket attached. Until management can provide concrete data on revenue, margins, and return on capital for its AI data center segment, the market’s skepticism is not just understandable; it's rational. The potential is there, but potential doesn't pay the bills. Execution does.