So, Microsoft’s stock finally blinked.

The market got a look at their latest forecast—a plan to ramp up spending even more—and for the first time in a long while, Wall Street collectively choked on its morning latte. The stock dipped. It wasn't a crash, not a catastrophe, just a little wobble. But in the world of Big Tech, where stocks are supposed to defy gravity forever, a wobble is an earthquake.

And I’m sitting here thinking: good. It’s about damn time.

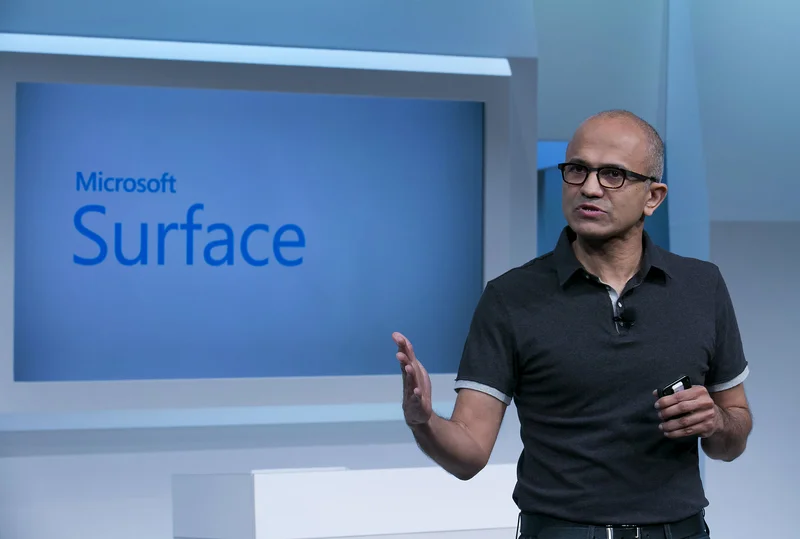

For the better part of two years, Microsoft has been on an absolute bender, a multi-billion-dollar spending spree fueled by one thing and one thing only: the all-holy, world-changing, paradigm-shifting magic of "AI." Every press release, every earnings call, every utterance from Satya Nadella has been a sermon from the Mount of Artificial Intelligence. And investors ate it up, pushing the stock to absurd heights because, hey, who wants to be the guy who bet against the future?

But the "future" is starting to look a lot like a bottomless money pit.

Let's translate the corporate-speak, shall we? When a company that's already spending billions on data centers and GPUs says it's going to "increase spending growth"—the very reason that Microsoft stock drops on forecast for increased spending growth this year—what it really means is, "We're doubling down at the casino. We haven't hit the jackpot yet, but we have a really good feeling about the next spin."

This isn't an investment strategy. No, 'investment' is too kind—it's a desperate scramble to own a technology nobody fully understands or has successfully monetized at scale. Microsoft is acting like a frantic prospector during the gold rush, buying up every shovel, mule, and plot of land in sight, convinced there's gold somewhere under all that dirt. The problem is, they're not selling the shovels; they're just digging, and the holes are getting terrifyingly deep.

They've poured billions into OpenAI, billions more into their own Azure infrastructure, all to power a technology that, for most people, is still a novelty. A fun toy for writing silly poems or generating pictures of frogs in business suits. Is it useful? Sometimes. Is it a revolutionary platform that justifies burning cash at a rate that would make a small country blush? I’m not seeing it.

And that brings up the real question, doesn't it? What, exactly, is the end game here? Are we supposed to believe that a slightly smarter Clippy in every Office app is going to generate hundreds of billions in new, sustainable revenue? Because right now, the AI arms race feels less like a calculated business venture and more like a vanity project of epic proportions.

Here’s what really gets me. While Microsoft is busy trying to solve artificial general intelligence, their core products—the stuff that hundreds of millions of us actually use every single day—feel like they're slowly rotting from the inside.

Just the other day, my PC forced another Windows update on me. It took 20 minutes, rebooted twice, and for what? Now the search function in my Start Menu is even worse. I can type the exact name of a file I saved three minutes ago, and Windows will stare at me blankly before suggesting I search the web for "TPS Reports." It's a joke. A multi-trillion-dollar company can't get basic file indexing right, but they want me to believe they're building the digital brain that will run the world. Give me a break.

This is the disconnect that Wall Street is finally sniffing out. The AI story is great for a headline, but it doesn't pay the bills—not yet, anyway. The bills are paid by Office subscriptions and Azure cloud services. And when you're siphoning off obscene amounts of capital to fund the sci-fi department, the core business is bound to suffer from neglect. They tell us this spending is essential for future innovation, but offcourse, the present is falling apart.

They want us to see this grand vision, this beautiful AI-powered utopia where productivity is limitless and every problem has a computational solution. And maybe they're right, but in the meantime...

Then again, maybe I’m the crazy one. Maybe I’m just some washed-up columnist who can’t see the forest for the trees. Perhaps in five years, we'll all be living in a Microsoft-run paradise, and this stock dip will look like a tiny blip. Or maybe, just maybe, this is the first cold splash of water on a market that's been drunk on hype for far too long. This ain't the future, it's a bubble looking for a pin.

For a while there, it seemed like the laws of financial physics didn't apply to Big Tech. Just whisper "AI" into a microphone and watch your market cap swell by another hundred billion. This little stock drop isn't a crisis for Microsoft. It's a reminder. A reminder that throwing endless piles of money at a problem doesn't guarantee a solution, and that sooner or later, even the most hyped-up narratives have to face the brutal reality of a balance sheet. Welcome back to Earth.