Okay, so Astera Labs (ALAB) just dropped their Q3 earnings, and on paper, it's all sunshine and rainbows. Revenue through the roof, EPS crushing expectations, margins expanding... the whole damn thing. A 104% year-over-year revenue jump? Give me a break. But then the stock tanks 6.4% after hours? What gives?

Is this just the market being its usual irrational self? Probably.

Let's look at the supposed good news. $230.6 million in revenue, beating estimates by a cool 11.7%. EPS at $0.49, a dime ahead of what the "experts" predicted. And this ain't a one-off thing; they've been consistently beating EPS for four straight quarters. The average surprise is 33%! Are they just sandbagging estimates to look good? I wouldn't put it past 'em.

Operating income swung from a loss to a solid $55.4 million. Net income? Same story. Gross margin up to 76.2%. It's like they're printing money over there. And the CEO, Jitendra Mohan, is talking about "continued PCIe 6 momentum" and "robust growth." Sounds great, right?

But Wall Street doesn't care about reality. It cares about narratives.

The whole "Scorpio fabric switch portfolio" expanding sounds impressive, but what does it actually mean? Are these real deals, or just vaporware promises? And this aiXscale Photonics acquisition... is it a smart strategic move, or just empire-building for the sake of empire-building?

Here's where it gets interesting. The stock initially popped in after-hours trading, then completely reversed course. Up almost 7%, then down 6.4%? That's not just a minor correction; that's a full-blown mood swing.

Analysts are still bullish, with most of them rating it a "buy" or better. The consensus price target is like $189. But analysts are always bullish, until they're not. They're paid to be optimistic, remember?

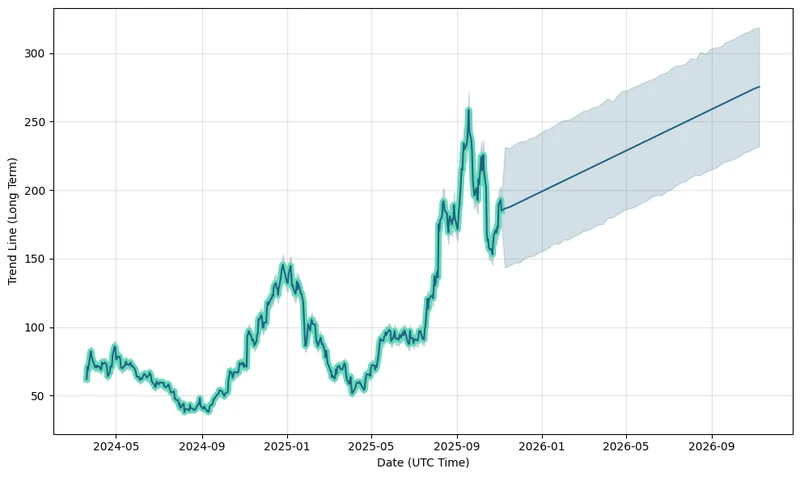

The intraday reversal screams "profit-taking." Plain and simple. People who got in early are cashing out, and who can blame them? The stock is still down 31.8% from its September high. Maybe some investors are looking at that high and thinking, "time to recoup some losses."

Is it also a sign of concern about valuation? Offcourse, it is! Are we really supposed to believe that this growth rate is sustainable? Eventually, the party has to end.

I saw some clown comparing it to Allegro MicroSystems (ALGM), another tech stock doing well. But comparing apples and oranges doesn't make a fruit salad. They're in different industries, different markets... it's all noise.

Let's be real, this whole thing feels like a house of cards. Great numbers don't always translate into stock market success, especially in this insane environment. Astera Labs might be doing everything right, but the market is a fickle beast. And maybe, just maybe, the market is smelling something rotten that we're not seeing yet. According to Astera Lab Continues Win Streak After Reporting Q3 Earnings - 24/7 Wall St., Astera Labs is continuing its "win streak" after reporting Q3 earnings.

It's all hype, man. A good quarter doesn't change the fact that the market is a casino, and sometimes the house wins, even when you think you've got a royal flush.