Okay, let's get this straight. SoundHound AI (SOUN), the supposed voice AI savior, took a 9.5% nosedive yesterday. Down to $14.23. Give me a break. One day they're the darling of HC Wainwright with a shiny new $26 price target, the next they're getting pummeled harder than a pinata at a toddler's birthday party. What gives?

And don't even get me started on the volume. 42.2 million shares traded? Below average. So, people are panicking, but not that much? It's like a lukewarm fire sale. Pathetic.

Here's where it gets interesting, or, you know, more depressing. CEO Keyvan Mohajer cashed out a cool $2.37 million worth of shares back in October. COO Michael Zagorsek did the same in September, pocketing over a million. Are we supposed to believe that these guys, who supposedly believe in the company's future, are suddenly diversifying their portfolios? Yeah, right. Smells like rats fleeing a sinking ship to me.

I mean, come on. "Over the last three months, insiders sold 785,917 shares of company stock valued at $13,955,610." That's not a vote of confidence, that's an all-out sprint for the exits.

But wait, they beat earnings estimates! By a penny. A single, solitary cent. And revenue was up too. $42.05 million versus the $40.48 million consensus. So, why the sell-off? Is the market just being a fickle beast, or is there something deeper at play here? Are these analysts smoking crack?

And then there's the analyst ratings. A "Moderate Buy" consensus with an average price target of $15.50? That's barely above where they closed yesterday. One "Strong Buy," five "Buy," four "Hold," and one lonely "Sell." The level of indecision here is staggering. Piper Sandler's "neutral" rating and $12 price target from July looks almost prescient now. Maybe they were right all along.

My own portfolio took a hit offcourse, but that's what I get for listening to the hype.

This company has a beta of 2.6. Translation: it's twice as volatile as the market. You might as well be betting on horse races. Add to that the negative return on equity and a net margin of -171.81%, and you've got a recipe for disaster. Equities analysts expect them to post -0.38 earnings per share for the current fiscal year. Well, duh.

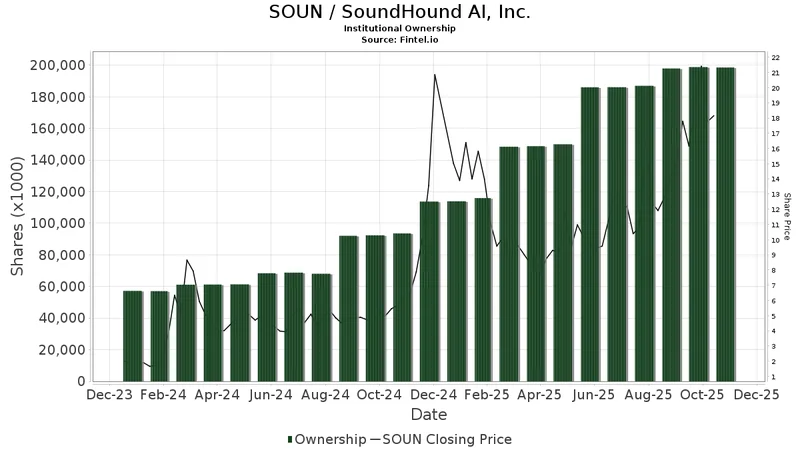

And 19.28% of the stock is owned by hedge funds and other institutional investors. That's a lot of smart money potentially looking for the door. Cookson Peirce & Co. Inc. lifted its stake by 400%, but who cares? Stratos Wealth Partners LTD. only upped theirs by 11%. It's all noise.

But let's be real, SoundHound is in the voice AI game, and that's a crowded space. They're not the only ones trying to make our devices talk back to us. What makes them so special? What's their secret sauce? Because I'm not seeing it.

This whole SoundHound situation is a classic case of hype versus reality. Analysts pump it up, insiders cash out, and the little guy gets left holding the bag. It ain't a pretty picture. Maybe voice AI is the future, maybe it's not. But one thing's for sure: SoundHound ain't the company to bet your retirement on.