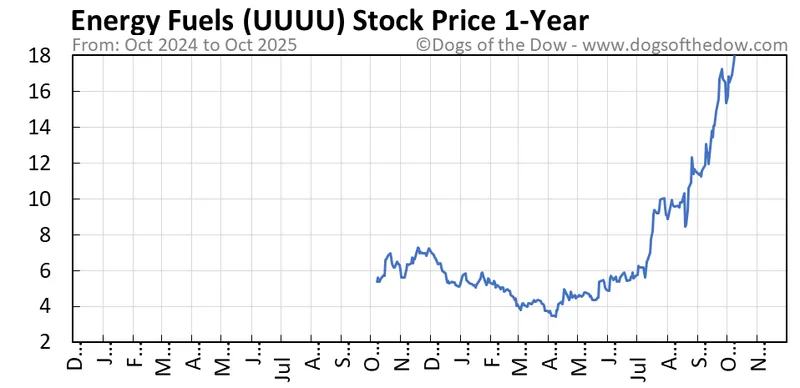

Energy Fuels is a story stock right now, and a compelling one at that. The ticker, UUUU, seems to be on every momentum trader’s screen, flickering a bright, insistent green. The narrative is almost perfect: a US-based company positioned at the intersection of two white-hot sectors—uranium for the nuclear energy renaissance and rare earth elements for, well, everything that powers the modern world.

The market has bought into this story with both hands. In a single recent session, the stock surged over 11%. This wasn't a random blip; it was the fourth consecutive day of gains, fueled by a perfect storm of catalysts. An analyst at B. Riley, seeing the momentum, doubled their price target on the stock from $11 to an ambitious $22. Simultaneously, news broke that China, the world's dominant producer of rare earths, was restricting exports. For a company like Energy Fuels, which is actively developing its own rare earth separation capabilities, this is the geopolitical equivalent of a winning lottery ticket.

The trading volume tells its own story. The average daily volume is around 17 million shares, but on this particular day, nearly a million shares had changed hands before most people had finished their morning coffee. It’s the kind of velocity that signals broad, enthusiastic participation. Retail investors see a clear path forward, and institutional funds are piling in, with data showing 155 funds adding to their positions recently. On the surface, every signal is flashing green. Why Shares of Energy Fuels Are Charging Higher Today

But my job isn't to look at the surface. It's to look at the machinery beneath it. And this is the part of the story that I find genuinely puzzling, because the data coming from inside the company tells a completely different tale.

When a company's prospects are truly transformative, you expect to see one thing from its leadership: conviction. This conviction is best measured not by press releases or conference call optimism, but by their personal financial decisions. Are they buying their own company's stock on the open market? Are they holding on for the massive upside they publicly champion?

For Energy Fuels, the answer appears to be a resounding no.

An analysis of insider trading activity over the past six months reveals a stark and, frankly, concerning pattern. During a period of explosive stock growth, there have been 25 open-market transactions by company insiders. Of those, zero have been purchases. Every single one was a sale.

Let’s be precise with the numbers. This isn’t a few minor executives trimming small positions. The Executive VP of Heavy Minerals Sands Operations, Timothy Carstens, sold over 460,000 shares—to be more exact, 460,612 shares—for an estimated $3.76 million. The VP of Radioisotopes, Saleem Drera, sold shares worth nearly $3 million. The SVP of Project Finance, Kevin Balloch, sold over $2 million worth. The list goes on, a cascade of senior figures liquidating their holdings.

This presents a fundamental disconnect. The public narrative, amplified by Wall Street analysts, is one of exponential growth and strategic masterstrokes. The private actions of the executive team, however, look like a coordinated sprint for the exits. It’s like watching the architects of a supposedly unsinkable ship quietly selling their tickets and heading for the lifeboats just as the vessel leaves port.

Why would a management team with a front-row seat to a potential rare earths boom be cashing out so aggressively? If the B. Riley analyst is correct and the stock is heading to $22 (and beyond), aren't these executives leaving millions of dollars on the table? These aren't questions that can be answered by a balance sheet or a geological survey. They point to a divergence between the story being sold to the market and the sentiment inside the C-suite.

The company's financial performance adds another layer of complexity. Energy Fuels has not demonstrated consistent profitability (its gross margin is currently a reported -7.96%), making it a speculative play even without the insider activity. It's an investment in a future promise, not a present reality. Investors are betting that the company can successfully scale its rare earths production to between 4,000 and 6,000 metric tons and capitalize on the uranium price cycle. It's a plausible bet, but one that carries an immense degree of risk.

The institutional ownership data offers a counterpoint, with more funds adding than subtracting shares. This is typical in a momentum-driven market. Funds are often mandated to chase performance, and a stock with this kind of upward trajectory is hard to ignore. But are they reacting to the fundamental story or just the price action? And how many have scrutinized the insider filings with the same lens?

We are left with two parallel, yet contradictory, narratives. One is a story of geopolitical opportunity and market euphoria. The other is a quiet, data-driven story of insiders taking profits at a remarkable clip.

Let's be clear. The strategic position of Energy Fuels is undeniably attractive on paper. A domestic source for uranium and rare earths is a national asset, and the market is pricing it as such. But markets are driven by stories, and sometimes those stories become detached from the underlying signals. In my experience, insider selling of this magnitude, especially with a complete absence of insider buying, is one of the most potent signals you can get. It doesn't guarantee the stock will go down, but it raises a significant red flag about the conviction of those who know the business best. While the market is buying the narrative, the management team is selling the stock. As an analyst, I know which data point I trust more.