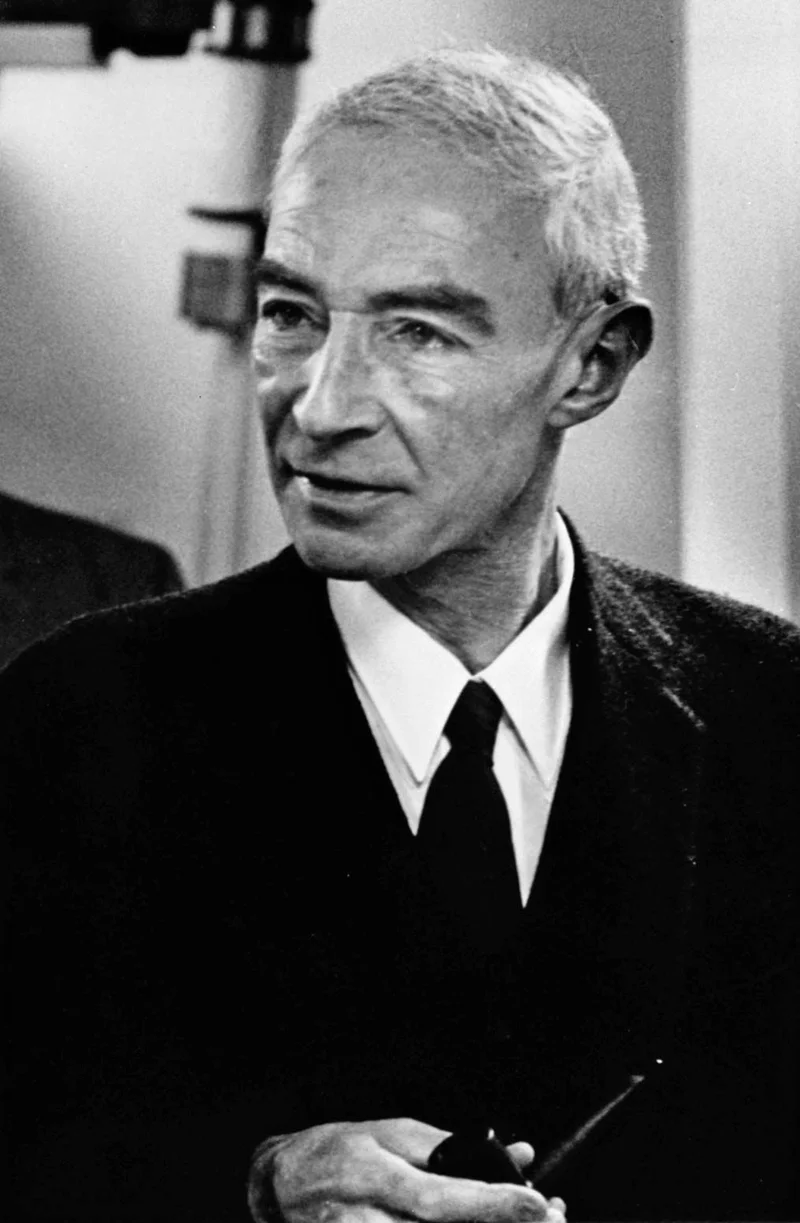

So, I’m scrolling through the news, and a headline hits me like a ton of bricks. Or maybe more like a ton of enriched uranium. Oppenheimer Raises the PT on Snowflake Inc (SNOW), Keeps a Buy Rating. And right there, my brain just stops. For a split second, I'm thinking about the movie, about Cillian Murphy’s thousand-yard stare, about the terrifying, world-changing physics.

But no. This isn't about J. Robert Oppenheimer, the man who brought us the atomic age. This is about Oppenheimer the financial firm, and an analyst named Ittai Kidron who just decided to become a destroyer of worlds for anyone shorting Snowflake Inc. (SNOW).

He jacked up their price target on the stock from $175 to $295.

Let that sink in. Not a gentle nudge. Not a "we're feeling a bit more optimistic" ten-percent bump. This is a full-throated, table-pounding, "I am become Death, the destroyer of bears" kind of upgrade. And my first thought wasn't "Wow, what a bullish call." It was, "What in the hell is this guy seeing that no one else is?"

Let's break down the official story, the little press-release-ready narrative they feed us. Kidron and his team at Oppenheimer maintained their "Outperform" rating on Snowflake and launched that price target into the stratosphere. Why? Because their "model" suggests "solid Q3 deal flows" and "strong lead generation for Q4."

"Solid." "Strong." These are the words you use when you have absolutely nothing specific to say. It's the corporate equivalent of answering "How are you?" with "Fine." It means nothing. It’s a placeholder for actual data. What does "solid deal flow" even mean? Did they sign three more mid-sized dental firms to their cloud platform? Did they finally get that contract with the local pet food distributor? Give me a break.

This is a bad idea. No, 'bad' doesn't cover it—this is a financially reckless pronouncement dressed up in analyst-speak. A jump from $175 to $295 is a 68% increase. You don't predict that kind of explosion based on "strong lead generation." You predict that when you think a company has secretly cured cancer or invented a teleportation device. Is Snowflake's cloud data platform suddenly going to achieve sentience and solve cold fusion?

I just can't shake the feeling that we're watching a performance. It's like a scene from the Oppenheimer film, with a bunch of guys in a room staring at a chalkboard full of equations that supposedly prove the chain reaction will work. But are we sure they carried the one? Are we positive their calculations don't end with the entire market's atmosphere catching on fire? Because that's what this feels like—a theoretical exercise with potentially catastrophic real-world consequences for anyone who actually listens.

They expect us to just nod along and buy, and honestly...

Remember the whole "Barbenheimer" phenomenon? The internet-fueled clash of two wildly different cultural juggernauts. On one side, you had the grim, serious, historically vital Oppenheimer. On the other, you had Barbie, a bright, fun, but surprisingly deep cultural commentary. This Snowflake call feels like the portfolio equivalent. You have the grim reality of a shaky market, inflation that won't die, and global instability. And then you have this analyst, painting a picture of a pink-hued dream world where a data stock is suddenly worth nearly $300 a share.

I'm not saying Snowflake is a bad company. They're a massive player in the cloud space. But the hype around AI has turned every tech company with a server and a slogan into the next big thing. The author at Insider Monkey who originally covered this even pointed out that other AI stocks might have more upside with less risk. And I think he's right. Piling into Snowflake at its current valuation, based on this single, explosive prediction, feels less like an investment and more like a Vegas bet. It's a gamble, offcourse.

What does it take to make a call like this? Do you have to channel the intense, haunted energy of Cillian Murphy as J. Robert Oppenheimer? Do you lock yourself in a room until you have a "eureka" moment like Einstein supposedly did? Or do you just realize that making an outrageous prediction gets your name in the headlines? I'm leaning toward the latter. It's the easiest way to get noticed in a sea of beige-suited analysts all saying the same thing. You don't become famous by predicting a 5% gain. You become famous by predicting the explosion.

Then again, maybe I'm the crazy one here. Maybe Kidron is the real Dr. Oppenheimer, and he genuinely sees the future path of data, AI, and cloud computing with a clarity the rest of us lack. Maybe I’m just some guy with a keyboard, watching the Trinity test from miles away through smoked glass, about to be proven spectacularly and humiliatingly wrong when the mushroom cloud appears right on schedule. It wouldn't be the first time.

Let's be real. This isn't an analysis; it's a spectacle. This price target isn't based on some secret, earth-shattering data nobody else has. It's a marketing stunt. It’s a financial firm planting a flag and screaming for attention in a deafeningly loud market. Following this advice feels like trusting a guy who says he can build a nuclear reactor in his garage. The potential upside is astronomical, sure, but the much more likely outcome is a messy, expensive, and deeply regrettable failure. I'm staying away. Far, far away.