The internet's buzzing again, this time with promises of a surprise $2,000 IRS stimulus check hitting bank accounts this November. Social media's fueling the fire, with posts claiming direct deposits are imminent. But before you start planning that vacation, let's inject a dose of reality – the kind that only comes from digging into the actual data.

Here's the bottom line: there's no credible evidence to support these claims. Officials have explicitly stated that no new stimulus or refund program has been authorized. The IRS is even warning people about phishing scams preying on this exact kind of hope, trying to snag personal and banking information. Color me unsurprised. It's a classic tactic: dangle a carrot, then steal the cart.

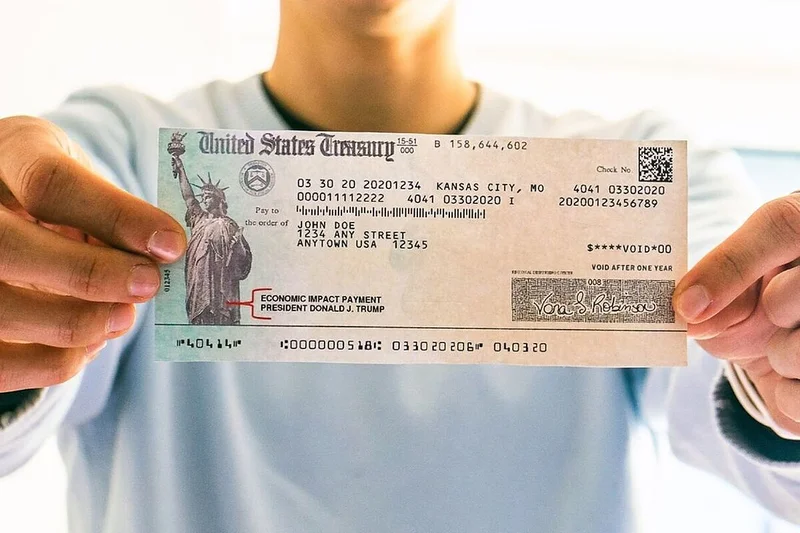

We've been down this road before. Remember the pandemic-era stimulus checks? The first round offered up to $1,200 per adult. The second, a paltry $600. And the third, in 2021, landed at $1,400 per taxpayer and dependent. The deadline to claim that last stimulus, or the Recovery Rebate Credit, was April 15, 2025. Any unclaimed funds? Back to the Treasury they went.

Now, Trump has floated the idea of using tariff revenue for taxpayer rebates – even mentioning a $5,000 "DOGE dividend." (I had to look that one up; apparently, it's a cryptocurrency reference. The man's full of surprises, or maybe just distractions.) But talk is cheap. There's been zero movement on any of this.

The IRS has a "Where’s My Refund" tool (irs.gov/refunds), updating once a day. You punch in your Social Security number, filing status, and refund amount. Most refunds, they say, arrive within 21 days of acceptance via direct deposit. That’s the official channel. Anything else should raise a red flag, and likely be avoided.

Officials are practically begging people to avoid third-party links or messages promising quick cash. Any request for bank details, fees, or personal data is a giant neon sign screaming "fraud." Always, always confirm updates through official government websites. Social media is an echo chamber of misinformation – treat it as such.

I've looked at hundreds of these "guaranteed payment" schemes. The pattern is always the same: a surge of hype, followed by a wave of disappointment and, for some, financial loss. It's a predictable cycle, and yet people keep falling for it. Why?

Is it desperation? A lack of financial literacy? Or simply the human tendency to believe what we want to be true? The data isn't clear on the why, but the what is undeniable: these scams thrive on hope and exploit vulnerability.

So, where do these rumors originate? Often, it's a mix of wishful thinking and deliberate misinformation campaigns. Someone throws out a number – say, $2,000 – and it spreads like wildfire across social media. No sources, no evidence, just a claim repeated often enough that it starts to sound plausible. $2000 IRS stimulus check coming in November 2025? Here's the truth

And here's where I get genuinely concerned. The sheer volume of these claims online points to a deeper problem: a widespread distrust of official sources. People are more likely to believe a random post on social media than a statement from the IRS. That's a dangerous trend.

The IRS says, “there are no confirmed $2,000 stimulus checks or any new IRS payments scheduled for November 2025.” Unless Congress suddenly decides to pass new legislation (like the American Worker Rebate Act, which has been kicking around for a while), don't expect any surprise checks.

The real story here isn't about stimulus checks. It's about the vulnerability of people and the willingness of scammers to exploit that vulnerability for profit. The promise of free money is a powerful lure, but it's almost always a mirage. My advice? Stay skeptical, do your research, and remember: if it sounds too good to be true, it almost certainly is.