Amazon's stock saw a bump – about 4%, give or take a rounding error – after announcing a $38 billion deal with OpenAI. The deal? OpenAI gets access to a boatload of Nvidia's AI chips through Amazon's cloud infrastructure. On the surface, it's a win-win. Amazon gets to flex its AWS muscle, and OpenAI gets the computing power it needs to keep churning out AI models. But let's dig a little deeper, shall we?

OpenAI isn't just cozying up to Amazon. They've got a $300 billion handshake with Oracle, a $22 billion commitment from CoreWeave, and agreements with Broadcom, AMD, and Nvidia. It's a regular AI infrastructure party, and OpenAI is footing the bill. Or, at least, promising to. The problem, as I see it, is the circular nature of these deals. It's AI companies buying from AI infrastructure providers, fueled by… well, more AI hype.

This reminds me of the dot-com boom, but with GPUs instead of websites. Everyone was buying everyone else's services, inflating revenues, and creating a mirage of unstoppable growth. Is AI different? Maybe. But the fundamentals of business still apply. You need revenue to exceed costs, and OpenAI's costs are projected to surpass $1 trillion by the end of the decade. That's trillion with a "T." Their revenue, last I checked, isn't anywhere close.

The question is, can OpenAI actually pay for all this AI horsepower? Or are they relying on future funding rounds and, ultimately, an IPO to cover the bills? And that IPO, rumored to value OpenAI at $1 trillion, hinges on… you guessed it, continued AI hype and growth. It's a house of cards, built on layers of silicon and fueled by investor optimism.

Amazon, of course, isn't a naive player in all this. They're not just handing out chips out of the goodness of their corporate heart. They're betting that AI is the future, and they want to be the pick-and-shovel provider for this new gold rush. Makes sense. AWS is already a cash cow, and AI workloads could be the next big revenue driver.

But here's where it gets interesting (and where I start to get a little uneasy). Amazon is also playing both sides. They're giving OpenAI access to Nvidia chips, but they're also providing OpenAI's rival, Anthropic, with 1 million of their own custom AI chips by the end of 2025. It's like being an arms dealer in a two-sided war. You profit no matter who wins.

I've looked at hundreds of these corporate announcements, and this level of hedging is unusual, even for Amazon. It suggests they're not entirely convinced that OpenAI is the definitive winner in the AI race. Or, perhaps, they simply want to ensure they maintain maximum leverage, regardless of who comes out on top.

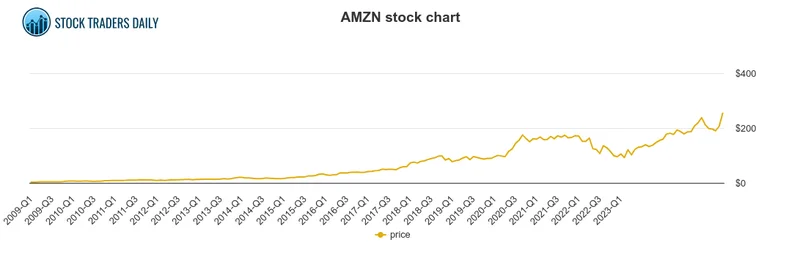

And this is the part of the report that I find genuinely puzzling. The earnings report came out last week and surpassed expectations, pushing the stock to an all-time high. This OpenAI deal feels almost like gilding the lily. Is Amazon trying to maintain momentum, or are they genuinely worried about being left behind in the AI arms race? Amazon stock jumps on $38 billion deal with OpenAI to use hundreds of thousands of Nvidia chips

We need to take a step back and look at how these deals are being reported. The financial press is quick to jump on any AI-related announcement, often without questioning the underlying economics. Every new partnership is hailed as a game-changer, every new funding round as a validation of the AI revolution. But who is doing the independent verification? Who is asking the hard questions about profitability and sustainability?

The answer, unfortunately, is not enough people. There's a self-perpetuating hype cycle at play, where positive news generates more positive news, attracting more investors, further fueling the hype. It's a classic bubble dynamic, and it's hard to break free from it.

The question isn't whether AI is transformative. It almost certainly is. The question is whether the current valuations and investment flows are justified by the actual, demonstrable economic value being created. And that, my friends, is a much harder question to answer.

Amazon's $38 billion deal with OpenAI is a headline-grabber, no doubt. But behind the impressive numbers and the stock price jump, there are some serious questions about the sustainability of OpenAI's business model and the overall AI investment landscape.